The inability to accurately assess risk for insurance purposes costs the industry a lot of money. Earlier this year, State Farm reported that its property and casualty insurance business would reach $13 billion in 2022 due to “rapid increases in claims severity and large additions to claims incurred in the prior year.”

Hub is trying to change that. The two-year-old company has developed a universal API for insurance data and is taking a “Plaid for insurance” approach, Axle co-founder and CEO Cameron Duncan told TechCrunch.

Several insurance companies operate to distribute insurance and administer the policy. Instead, Axle, started by Duncan, Armaan Sikand and Nihar Parikh, provides access to real-time insurance data, automated insurance verification and ongoing coverage monitoring so that customers, such as car rental companies, can reduce their operating costs.

“In the insurance industry today, there is a lot of focus on how we use artificial intelligence to improve underwriting, but connectivity is where we come into play: how do we interact with the rest of the world?” Duncan said. “Our mission is to bridge the gap between insurance and parallel industries such as car lending, real estate, and mortgages.”

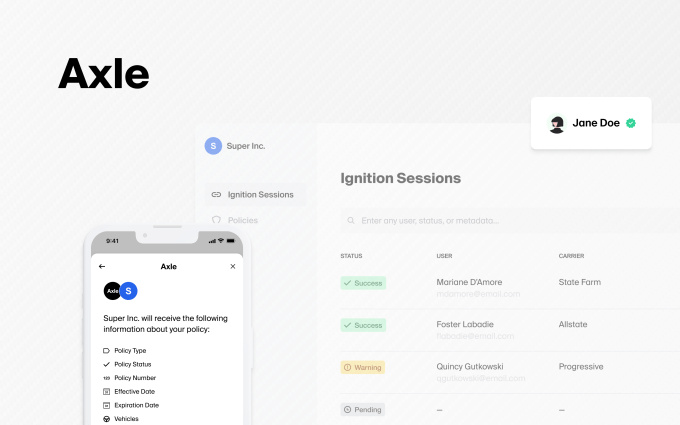

Hub Products (photo credit: Hub)

Similar to how Plaid leverages a user-authorized data platform for banking, Axle allows users to connect their insurance accounts to trusted companies in seconds through a developer-friendly API or one of Axle’s low-code or no-code options.

After launching a year ago, the company is seeing double-digit growth in customer and revenue and has grown its carrier network by over a hundred carriers.

Now Axle is filled with $4 million in seed funding. The round was led by Gradient Ventures and included investments from existing investor Y Combinator, participation from Soma Capital, Contrary Capital, Rebel Fund, BLH Ventures, and a group of angel investors, including members of the founding team of Plaid and former executives from Cox Automotive.

The co-founders intend to deploy the new capital into additional placements, expand carrier coverage and add different markets and use cases. There are two growth angles for Axle, including additional lines of insurance, for example, boat and commercial insurance and healthcare, and moving laterally with use cases around other types of verification and claims submission.

“Verifying data is very complicated,” Sekande said in an interview. “Part of our technology is also to be the first to truly build a unified way to understand and digest data.”